The Forward Wonk #9: Embracing Automatic Stabilizers

What They Are, How They Work, and Using Data To Expand Them

Welcome to the ninth issue of The Forward Wonk!

This was a funny tweet.

This week’s read will take you about 6 minutes to read.

Did someone forward you this? Subscribe!

Hi everyone,

I’m back again to talk about one of my favorite macroeconomic policy ideas — automatic stabilizers. Today’s post is going to be a bit rambly as I try to get us to think about this together.

With last Thursday morning’s labor market data drop showing continued elevated unemployment, coupled with Congress’s lack of further meaningful fiscal support, it’s time to implement serious solutions to avoid a prolonged economic depression.

Unsurprisingly, the economic contraction is caused by fears of the virus and not the lockdowns cities and states are enforcing. People aren’t leaving the house because they’re scared of the virus. So far, our fiscal response has been lackluster. It’s been weeks (almost months) since Congress passed meaningful monetary support for small businesses, families, and state and local governments. Gridlock and polarization in Congress is costing the livelihood of millions of Americans.

Why Is It Hard To Pass Policy?

When an economic crisis occurs, there are two large avenues of policy responses: monetary and discretionary fiscal policy. As we’ve discussed, the Federal Reserve controls monetary policy, while Congress controls discretionary fiscal policy, which includes changes in tax rates or government spending. Essentially, through discretionary fiscal policy, Congress can spend money or change the tax code to help stabilize the economy, provide assistance to people, and create jobs.

In both the Financial Crisis and Coronavirus crisis, Congress routinely failed adequately mitigate damage from the economic fallouts even as the Fed acted. Economic rescue legislation becomes pieces of paper for lobbyists, businesses, and special interests to cram provisions into, making politicians bicker. Many much more smarter people have documented the causes of polarization and legislative gridlock, so I won’t go into any further discussion, but these reasons are further amplified during a crisis. Congress can’t get anything done so meaningful economic relief never passes.

Now, how can you expect Congress to get anything done? You don’t. Your expectations for Congress are on the floor, and even then they’re not met. Hence why the calls for automatic stabilizers.

What Are Automatic Stabilizers?

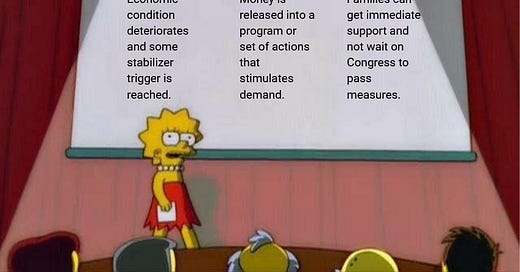

Automatic stabilizers are economic policies that automatically engage in actions if some conditions are met. These are typically actions Congress would take with discretionary fiscal policy measures. For example, if unemployment reaches 7 percent, an automatic stabilizer can double unemployment insurance benefits. Without waiting for Congress to draft a bill, bring it to the floor, and pass it, automatic stabilizers automatically get support out into the hands of people.

How I think I look like when I write this newsletter

To get a further understanding, The Washington Center For Equitable Growth has gathered some proposals for different automatic stabilizers. These include:

[E]xpand eligibility for Unemployment Insurance and encourage take-up of its regular benefits…strengthen the Extended Benefits program by several means, including making it fully federally financed.

[I]ncreasing the federal matching rate for Medicaid and the Children’s Health Insurance Program during economic downturns.

[L]imit or eliminate work requirements for supplemental nutrition assistance [author’s note: aka food stamps] during recessions or permanently and to automatically increase benefits by 15 percent during recessions.

[A] countercyclical stabilization program through the Temporary Assistance for Needy Families program that would expand federal support for basic assistance during recessions and create a new, ongoing program to support state job subsidy efforts and provide a larger federal match of that state spending during economic downturns.

[A]n automatic infrastructure investment program. The federal government would help states develop and maintain a catalogue of potential infrastructure projects, with the work on projects triggered at signs of a coming recession. Under the proposal, funding for the Better Utilizing Investments to Leverage Development, or BUILD, program, run by the U.S. Department of Transportation, would automatically be expanded in a recession to get top projects underway relatively quickly.

[B]oost consumer spending during recessions by creating a system of direct stimulus payments to individuals that would be automatically triggered when rising unemployment signaled a coming recession. Additional annual payments would be triggered if the recession continued beyond the first year.

We know that economic crises are painful for millions. Families lose savings and jobs. Young people are forever daunted by the labor market. People lose health insurance and face hunger. Businesses fail and bring communities down with them. Local and state governments face crippling budget cuts. This is awful, but our government possesses the tools to help soften the blow. Automatic stabilizers will ensure that some of these tools are guaranteed to be used and not left to partisan politics.

The whole idea to agree upon some set of actions before a crisis occurs so those actions can occur without any political roadblocks. And this is a powerful moral argument, in my opinion. Fiscal support can change lives, especially in a crisis. What I sadly see are many economists/policymakers/policy analysts with power and influence not understanding or ignoring the importance fiscal policy plays in improving people’s livelihood. Giving people support, whether that’s through increased food stamp access, a stimulus check, or expanded unemployment insurance, will save lives and increase the wellbeing of millions. Automatic stabilizers ensure a minimum level of support given.

While automatic stabilizers are a worthy idea, they carry two large drawbacks in my eyes:

Cost: Nearly all legislation needs to be scored by the Congressional Budget Office (CBO) for cost before it can be passed. The way the CBO currently scores bills make automatic stabilizer look excessively expensive. The timing of when legislation is proposed also affects the CBO score.

The CBO uses probabilistic models to estimate the cost of legislation over a ten-year window, and these probabilities will change due to the economic condition. If you propose automatic stabilizers during a recession, the cost will be higher than if you propose if during a boom time, because the probability of paying out the expanded policies over the next ten years are elevated during a recession.

While the costs are high, they rival what the government would end up spending on fiscal policy anyways. Moreover, those deficits can be balanced with a surplus once economic recovery is achieved. Nevertheless, automatic stabilizers carry a large cost and that “sticker shock” will keep it from being considered among certain political circles. This is what is keeping automatic stabilizers back the most.

Data granularity: This is a more niche problem that annoys me, but economic data typically contain significant lags. It can take weeks to months for survey results and data to be tabulated. Some families can’t afford to wait that long for relief. Although it isn’t always reflected in traditional economic data, economic contractions have immediate consequences and victims. Luckily, there’s been an explosion of private sector data that we can tap into to feel the realtime economic pulse.

Tackling Data Lags

One of the most frustrating things about economic data for me is the lag. We only know the scale of economic damage AFTER it happens. While there are talented economic forecasters working to anticipate economic conditions, they’re still limited by the nature of these data. Increased access to quality, real-time data expand the scope and accuracy of our economic measures. These data allow us to realize the state of the economy much quicker and more accurately.

Economists are just beginning to tap into the vast data available to them. You’re probably tired of all the “big data for X” takes, but economics is well-positioned to use new data — especially for macroeconomic forecasts and measures. There are two large categories of data that can be used to support traditional economic data:

Private Sector Activity: These are data that measure business operations and revenue. Examples include OpenTable reservation data or hours clocked by small business employees on Homebase.

Social Sentiment: These are data that attempt to measure how people are reacting to economic conditions. Examples include Google Searches for “unemployment insurance” or the number of Tweets asking for help enrolling for COBRA benefits.

They can all come together into something like this:

Combining non-traditional data to create economic insight is a great way to tackle novel problems. With this data, economists can create new models and rules to measure economic conditions and tie into automatic stabilizers. Adopting new data and models allow us to quickly provide support when people need it. Economists/policymakers/policy analysts maintain a duty to serve others and use the data around them to understand people’s realities. Combining these data seem like a logical next step.

If this reminds you of the “collect, analyze, and act” systems we’ve talked about, your line of thinking is correct (and I’m very, very proud of you). Automatic stabilizers are an (automatic lol) example of these systems and expanding them to collect and analyze more relevant data will only improve their effectiveness. Careful analysis of data can be used to insulate people from the damage brought by economic shocks.

To recap:

Congress can’t get things done during an economic crisis. Instead, automatic stabilizers can be used to counteract some of the economic consequences. Even if we could trust Congress, automatic stabilizers allow for unmitigated relief.

Automatic stabilizers are policies that change government spending or tax structures when some threshold is met, like a specific unemployment rate.

Combining traditional economic data with other data, including private sector activity and social sentiment data, can allow us to have much more accurate forecasts and metrics.

These forecasts and metrics can be used as triggers for automatic stabilizers.

While political support of automatic stabilizers does seem to be slowly trickling into the offices of elected officials (including a bill introduced to the Senate floor last week), it’s unlikely that Congress will pass comprehensive automatic stabilizer legislation soon. Nevertheless, having thoughtful, pragmatic proposals is essential for proper advocacy and implementation. During these times, we need as many crazy, yet feasible, ideas as possible to counteract the economic hardship faced by millions.

Closing Time

Remember, humanity is creative and resilient. Humans continually overcome challenge after challenge after challenge. Automatic stabilizers are just one of many creative solutions being proposed to fight our hardship. Developing and experimenting with creative solutions is the only guarantor of progress. But it’s up to us to continue creating solutions. No one else will do it.

In the meantime, here’s what I’ve been reading and listening to.

This incredible Twitter thread by Anna Gifty about the power of economics.

How to Give Workers a Raise Without Employers Paying for It (NY Times Op-Ed)

Expanding Medicaid Makes Financial Sense. Plus, Voters Love It (Slate)

Can artificial intelligence be emotionally intelligent? (The Ezra Klein Show)

Wash Us In The Blood By Kanye West featuring Travis Scott

And Vik’s puzzle:

Have a great rest of your week,

Visakh

About the author: Visakh an economics and physics student with data science and public policy experience. He enjoys sports, music, and drinking tea in his free time.

Crossword Answers:

Across

MSGS

ILIAD

KARMA

ACTOR

KHAN

Down

MIKA

SLACK

GIRTH

SAMOA

DARN